Table of Contents

ToggleThe new era of regulatory enforcement demands companies and compliance teams to stay ahead of the curve by leveraging cutting-edge AI technologies designed to identify, manage, and mitigate risks while assuring compliance.

One such technology that is making significant strides in making access to data as convenient as possible is chatbots powered by generative AI, machine learning, and data science techniques.

By transforming CMS Open Payments data and the organization’s internal data into actionable intelligence, these chatbots are revolutionizing how compliance officers and their teams operate and ensure compliance at all levels of the organization.

Let’s take a detailed look at seven ways AI chatbots transform CMS Open Payments data into actionable intelligence while understanding the expectations of regulatory authorities from the life sciences compliance program.

1. Seamless Access to CMS Open Payments Data

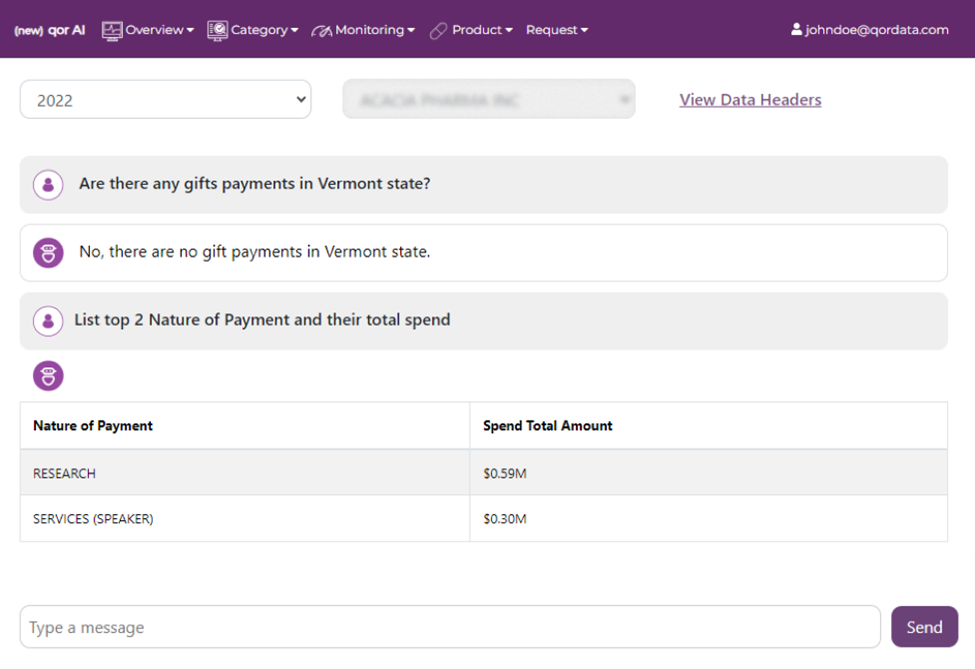

Generative AI chatbots enable compliance officers to interact directly with CMS Open Payments data through natural language queries.

This technology provides easy and immediate access to comprehensive data on spending, payment trends, and HCP interactions, eliminating the need for complex data retrieval processes.

By simply asking questions in plain language, compliance officers can access detailed information, streamlining their workflow and making the data more accessible to all team members, regardless of their technical proficiency.

Example in Action:

Imagine you need to quickly understand the top payments made to a particular HCP or identify trends in payments related to specific medical specialties.

With an AI chatbot, you can ask, “What are the top five payments made to Dr. Smith in 2023?” and receive an instant, detailed response without sifting through spreadsheets or databases.

2. Advanced Analytical Insights

AI chatbots retrieve data and analyze it to provide actionable insights.

These insights can include spending patterns, payment trends, anomalies, and specialty-specific data, offering a comprehensive understanding of the financial relationships between the industry and HCPs.

This analytical capability is essential for identifying potential compliance risks and ensuring that interactions remain within legal and ethical boundaries.

Example in Action:

A compliance officer can ask the AI chatbot, “Show me the trends in payments to cardiologists over the last five years and compare it with the industry data?“

The chatbot can then generate a detailed analysis, highlighting any unusual spikes or patterns that may warrant further investigation.

3. Insightful Analytical Dashboards

Beyond text-based insights, AI chatbots can create and manage dynamic analytical dashboards.

These dashboards provide a visual representation of key metrics, allowing compliance teams to drill down into specific data points for a more granular analysis.

Viewing data in textual, tabular, and graphical formats enhances understanding and supports more informed decision-making.

Example in Action:

A compliance officer might request, “Show me a dashboard of transfer of values (ToV) and categorize them as per nature of payment for 2023.“

The AI chatbot can then generate a comprehensive dashboard that visually breaks down payments into categories such as consulting fees, travel expenses, and gifts, facilitating easier monitoring and analysis.

4. Simplified Data Integration and Analysis

AI chatbots can integrate external data with CMS Open Payments data, providing a holistic view of compliance-related information.

Compliance officers can upload and query their organization’s datasets alongside the CMS data, gaining deeper insights and making more informed decisions.

This feature is particularly useful for comparing internal policies and practices against industry standards and regulatory requirements.

Example in Action:

A compliance officer could upload internal expenditure data and ask, “How do our travel expense payments compare to industry standards?”

The AI chatbot can then analyze both datasets, providing a detailed comparison highlighting discrepancies, erroneous data, or improvement areas.

5. Enhanced Decision-Making Through Natural Language Processing

One of the major advantages of AI chatbots is their ability to process natural language prompts.

This capability drastically reduces the learning curve associated with traditional data querying methods, enabling compliance officers to obtain necessary information quickly and efficiently.

The intuitive interface means that even team members with limited technical expertise can effectively use the chatbot to access and analyze compliance data.

Example in Action:

A team member could ask the chatbot, “What are the meal limits for HCPs in New York?” and receive an immediate response with references to relevant compliance policies and regulations.

6. Access to Comprehensive Compliance Knowledge

AI chatbots can support the development of effective lines of communication, a key element of a compliance program, by serving as a central repository for compliance knowledge across the organization.

They can provide insights into compliance-related topics such as third-party engagement policies, historical instances of non-compliance, topic or query-specific guidance and more.

This centralized access ensures that all team members are on the same page regarding compliance requirements, reducing the risk of violations and enhancing overall compliance posture.

Example in Action:

A sales representative preparing for a meeting with an HCP can ask, “What are the specific meal policies for HCPs in New Jersey?“ and receive immediate, accurate information, ensuring that their interactions remain compliant with state-specific regulations.

7. Integration with Regulatory Documents and Training Materials

AI chatbots can integrate with key regulatory documents and training materials, providing instant access to critical information.

This feature supports ongoing education and training efforts, ensuring compliance teams stay current with the latest regulations and best practices.

The ability to reference documents such as the PhRMA Code, OIG Compliance Guidance, and CMS reporting rules within the chatbot enhances its utility as a comprehensive compliance tool.

Example in Action:

During a compliance training session, a team member could ask the chatbot, “What are the key points of the OIG Special Fraud Alert on Speaker Programs?”

The chatbot can then provide a detailed summary, supplemented with links to the full document for further reading.

What Regulatory Authorities Expect from Life Sciences Compliance Programs?

Regulatory authorities like the U.S. Department of Justice (DOJ) ask three key questions when evaluating corporate compliance programs:

- Is the compliance program well-designed?

- Is it adequately resourced and capable of functioning effectively?

- Is it working in practice?

AI-driven data analytics can significantly help companies meet such expectations. Here’s how:

- Concrete Evidence: Prosecutors prefer data over opinions. Integrating data analytics into compliance programs allows companies to provide objective and verifiable evidence.

- Risk Management: The DOJ values effective risk management and resource allocation. Data analytics enhances these processes, revealing crucial patterns and trends.

- Risk Assessments: Data analytics objectively assesses company risks, including third-party risks, demonstrating a commitment to evidence-based risk and proactive wrongdoing detection.

- Resource Proportionality: The DOJ expects companies to show compliance resources match their risk profile. Data analytics helps demonstrate this proportionality.

- Operational Effectiveness: Using data analytics to test 100% of financial transactions for non-compliance, ideally globally and in real-time, gives a clear, data-driven picture of the program’s effectiveness.

Leveraging data analytics powered by AI ensures compliance practices are robust, effective, and based on solid evidence.

AI Chatbots are making it seamless for compliance officers and life sciences organizations to access contextual information through data and use it to enhance compliance throughout the organization.

Conclusion

AI chatbots are transforming the landscape of compliance in the life sciences industry.

By providing seamless access to CMS Open Payments data, delivering advanced analytical insights, and facilitating comprehensive knowledge access, these chatbots empower compliance officers to make more informed decisions and enhance their compliance programs.

As technology evolves, its potential to drive efficiency, improve accuracy, and support regulatory adherence will grow, making it an indispensable tool for compliance professionals.

Embracing AI chatbots is not just a step towards modernization but a strategic move towards achieving excellence in compliance management.

Other Relevant Read: