Compliance Risk Assessment

Our services are designed to help you identify, evaluate, prioritize, and mitigate compliance risks efficiently and effectively, across your organization. Our experienced team has a deep understanding of compliance and regulatory challenges. qordata will tailor risk assessment to your specific needs, ensuring a comprehensive risk evaluation.

What is compliance risk assessment?

Evaluation of risk factors relative to the organization’s compliance obligations, considering:

- Guidance from authorities such as the Office of Inspector General (OIG) and the Department of Justice (DOJ)

- Requirements and regulations

- Policies and procedures

- Ethics and business conduct standards

- Contracts

- Strategic voluntary standards and best practices to which the organization has committed

This type of assessment is typically performed by the compliance function with input from business areas.

How is compliance risk assessment performed?

- Determine risk assessment objectives. Some examples below:

- Evaluate risks associated with industry requirements, best practices and standards.

- Ensure adherence to guidance from authority.

- Protect the company’s reputation and brand.

- Avoid financial losses and penalties.

- Identify stakeholders across functions you need input from.

- Identify risk areas by keeping a close eye on laws, requirements, regulations and policies such as Anti-Kickback Statute (AKS), Stark Law and Foreign Corrupt Practices Act (FCPA). This could be done either by circulating a set of questionnaires to all stakeholders, interviewing them, or running a workshop. The aim is to answer the below question:

- What can stop the organization to from achieving its objectives?

- Prepare a consolidated list of risks including historical and current risks.

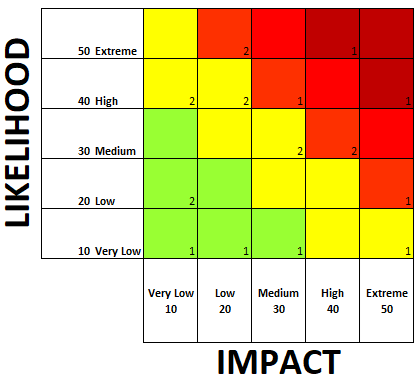

- Perform risk analysis and determine:

- Likelihood

- Impact

- Inherent Risk

- Process Controls

- Residual Risk

- Generate a risk heatmap and prioritize risks based on the impact and likelihood of occurrence.