Expense Monitoring & Auditing Solution

Audit 100% of your expense reports within a few minutes.

Our solution leverages Artificial Intelligence (AI) with the following key features:

SAP Concur integration to extract reports with the ability to connect with other T&E systems

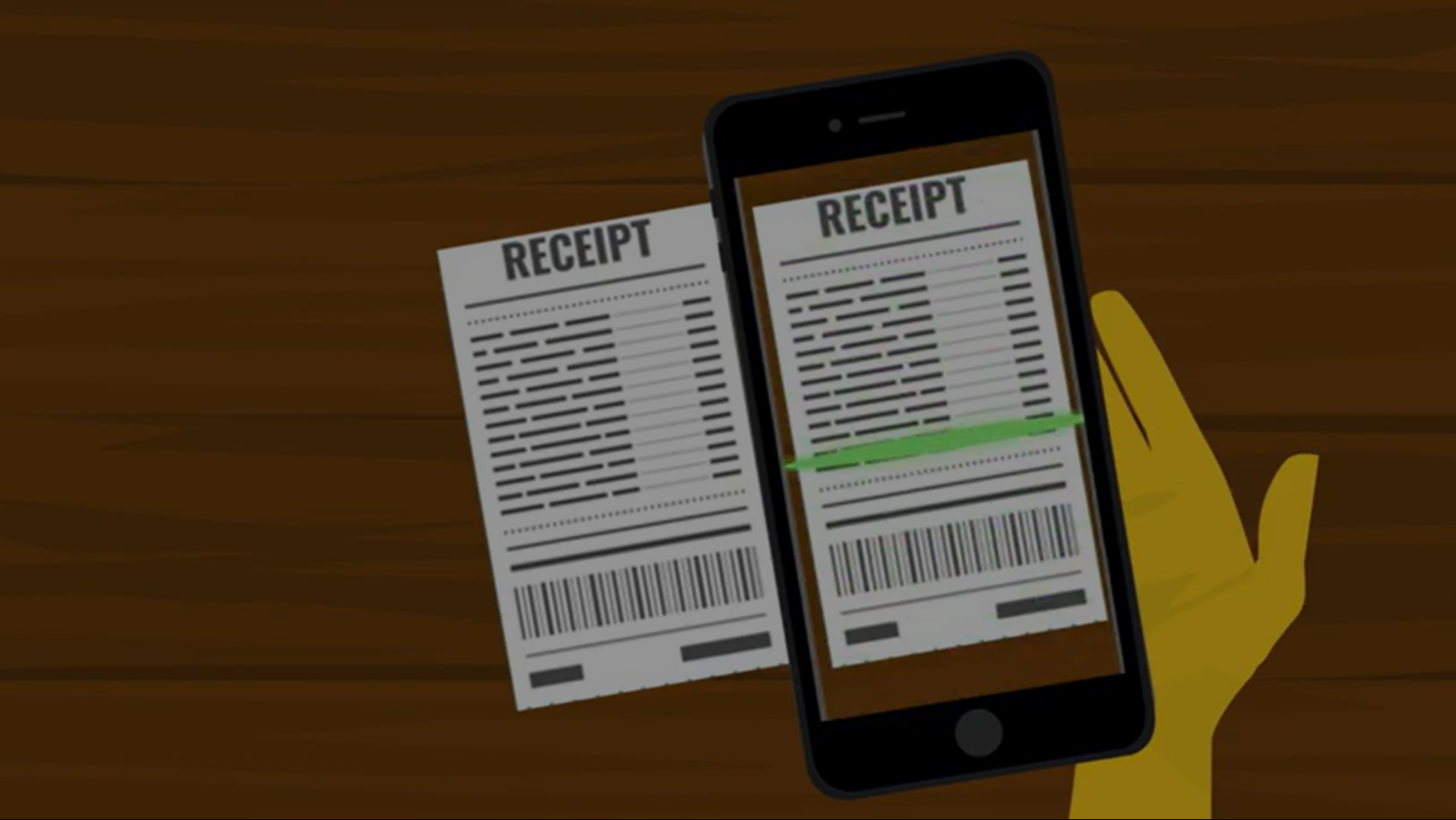

OCR & computer vision to convert meal receipts, boarding passes, sign-in sheets, and other expense receipts into machine-readable text

Reconciles expense reports against sign-in sheets and receipts

Utilizes Machine Learning (ML) to detect anomalies in sign-in sheets such as; white-outs, incompleteness, and same-person signature

Checks against company, state, and country policies and requirements

Flags non-conducive venues

Built-in and configurable audit rules as per industry best practices

Identifies risk patterns and marks for further monitoring and remediation

Comprehensive insights/analytics

Global coverage

White-out Detection

White-out Detection

Machine learning algorithms can be trained to identify patterns and anomalies in expense data. AI can flag unusual spending patterns, duplicate expenses, expenses that deviate from established guidelines or thresholds, or detecting inconsistencies in signatures, text, or formatting that may indicate the use of correction fluid; enabling auditors to focus their attention on high-risk transactions.

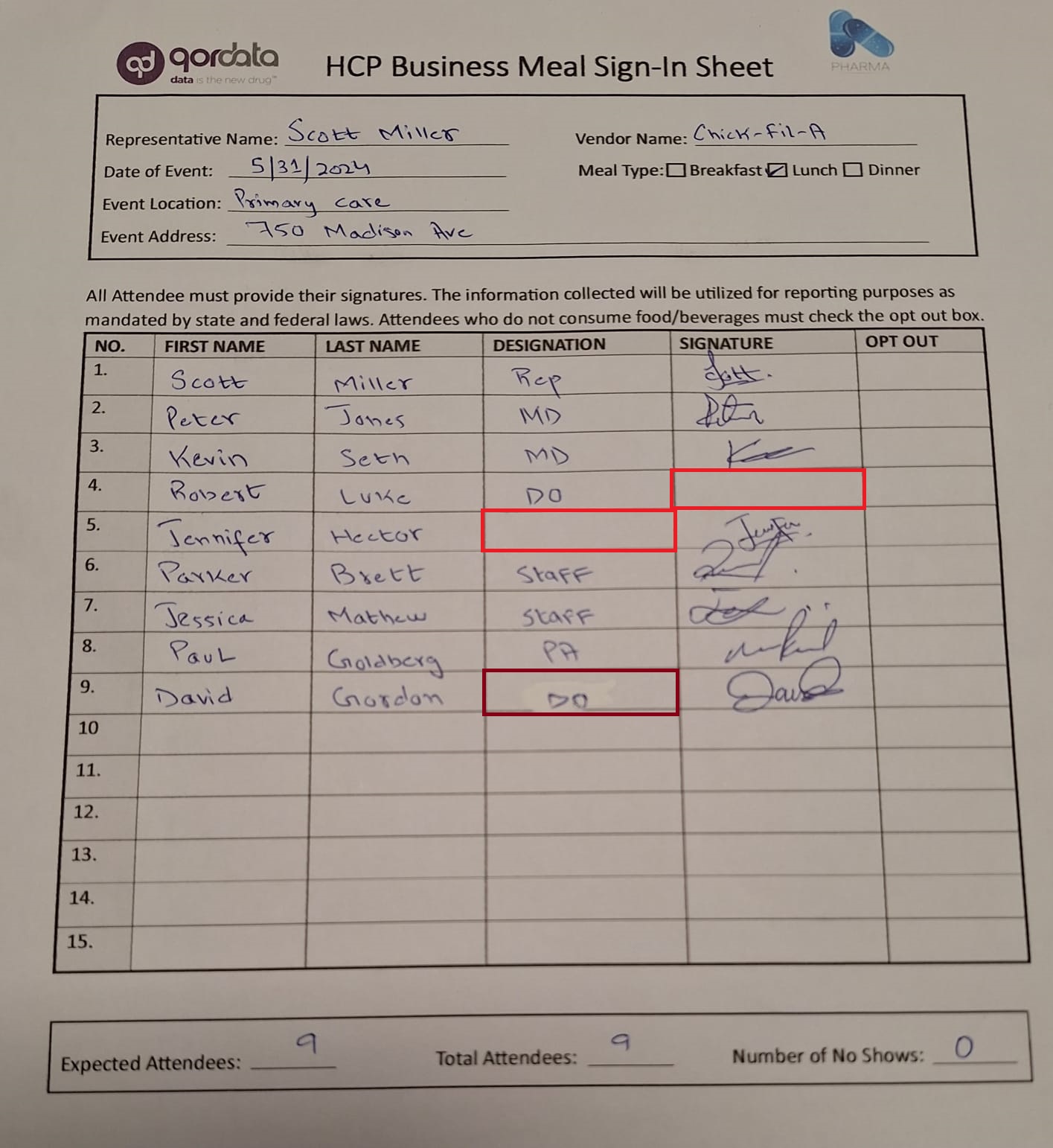

SAP Concur Integration

SAP Concur Integration

AI-powered expense audit solutions can seamlessly integrate with existing workflow systems and financial software platforms, streamlining the audit process and enabling real-time monitoring and analysis of expenses.

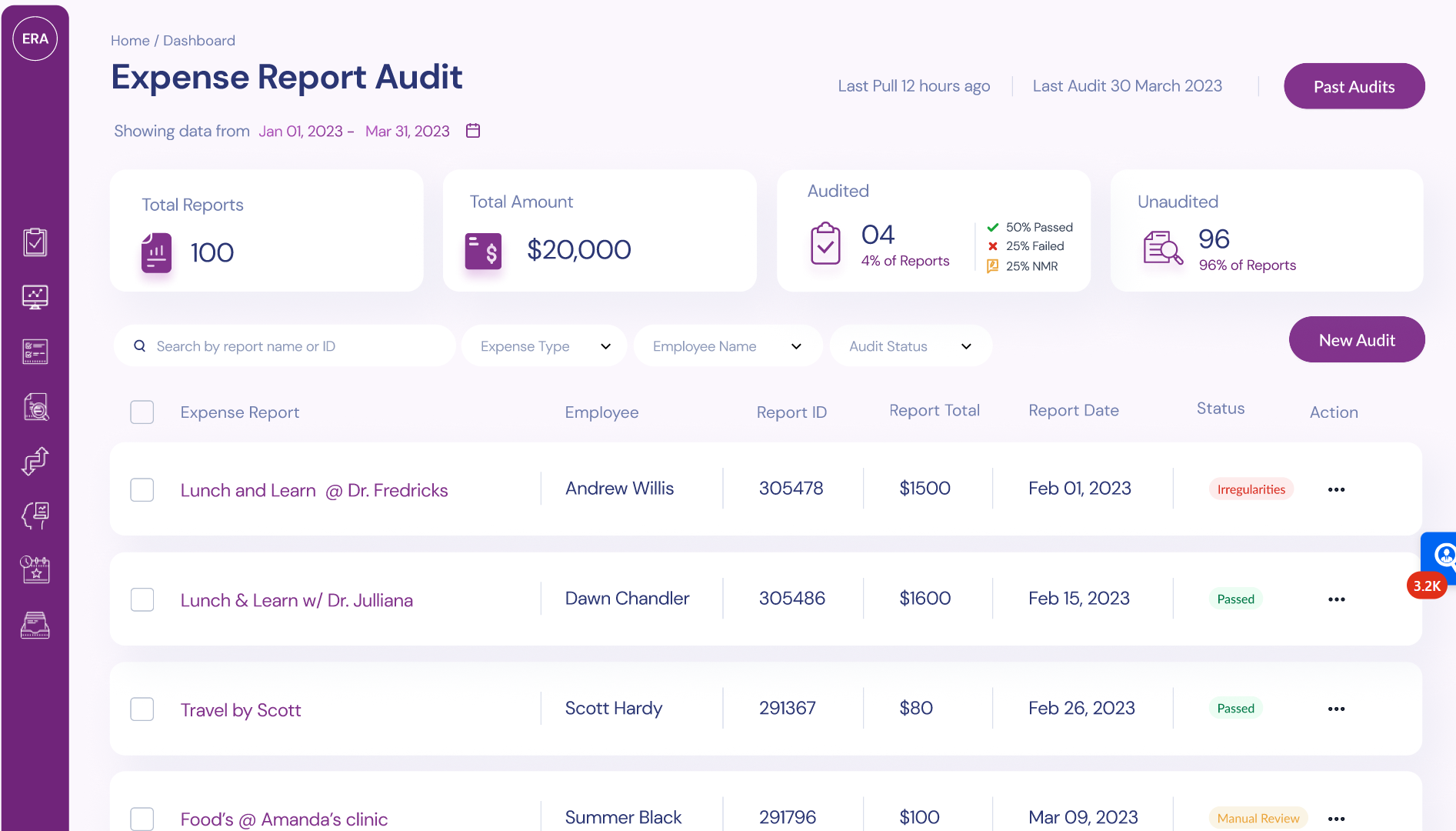

Comprehensive Expense Audits

Comprehensive Expense Audits

AI can help detect potential instances of fraud or misconduct by analyzing expense data for suspicious activities or behaviors. By applying predictive analytics and anomaly detection techniques, AI can identify outliers and potential instances of fraud, such as unauthorized expenses or inflated invoices.

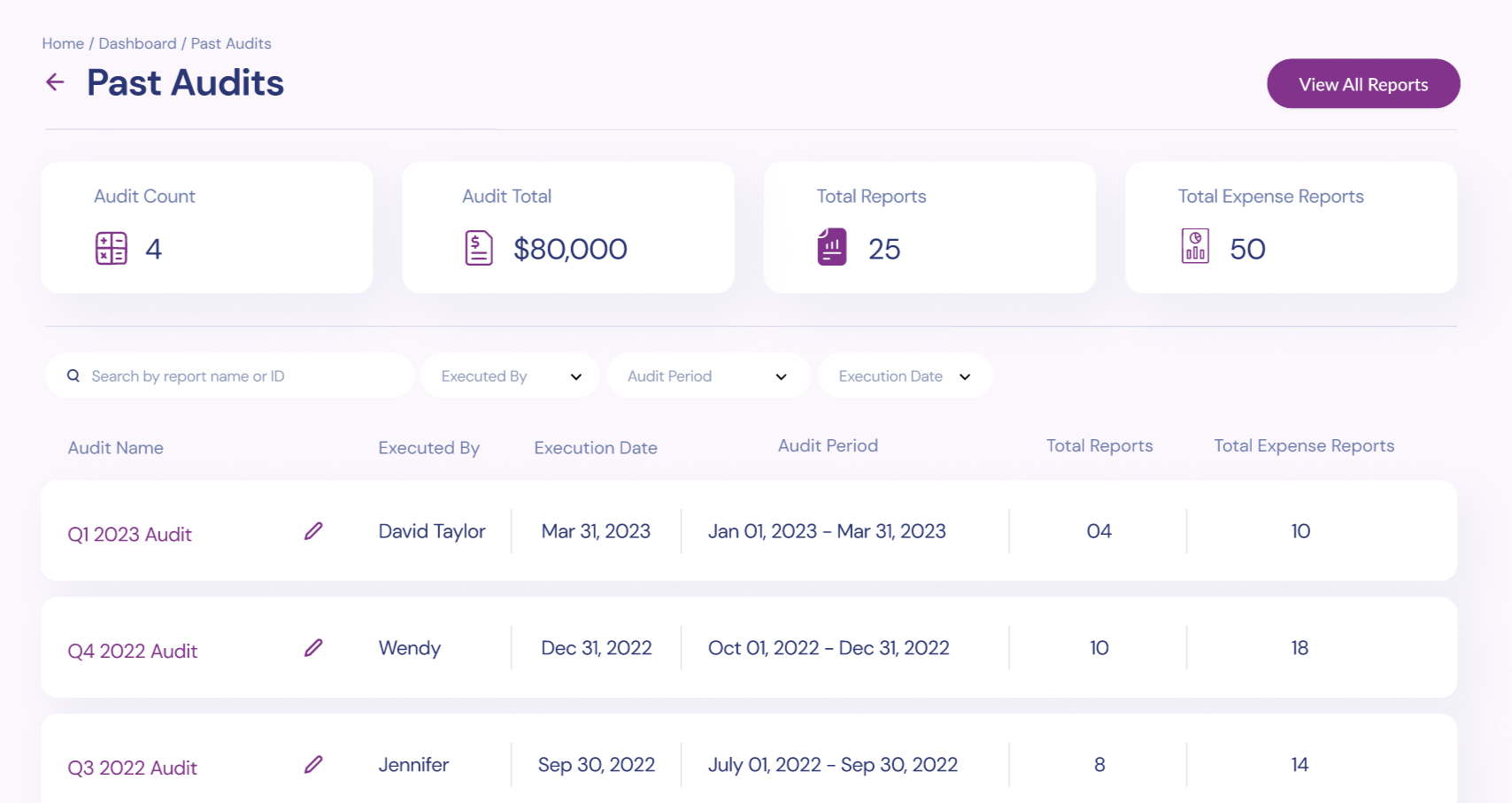

Past Expense Audits

Past Expense Audits

AI-powered systems can continuously monitor expenses against regulatory requirements, industry standards, and company policies. By automating compliance checks and validations, AI can ensure that expenses are in line with regulations and guidelines, reducing the risk of non-compliance and regulatory penalties.

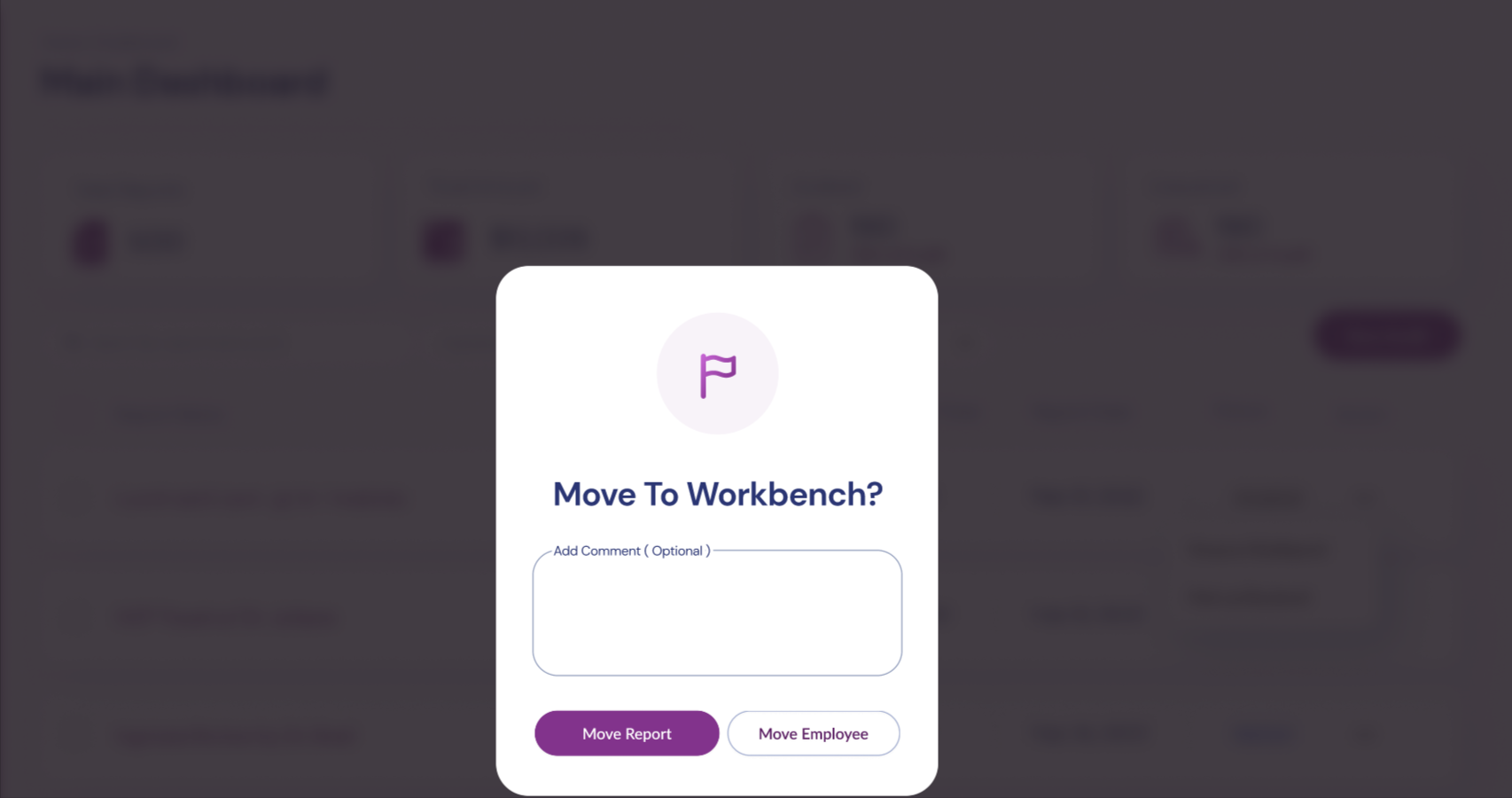

Risk Remediation

Risk Remediation

Manage risk remediation effectively and efficiently by moving risky reps and reports to the workbench. View consolidated expenses data. Stay compliant, and simplify the expense reporting process.